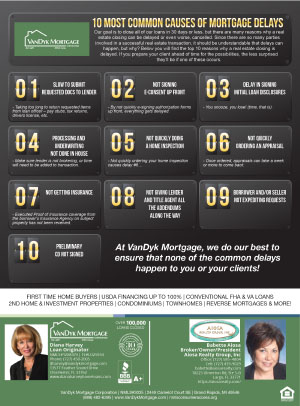

Top Ten Most Common Causes of Mortgage Delays

Want to close in 30 days?

Want to close in 30 days?

Because there are many individuals involved with a closing, surprises may happen to cause your mortgage to be delayed. Here are some reasons why your mortgage could fall behind your scheduled 30-day closing date. These are great tips to be aware of as you are working your way towards your new home!

Click here for a downloadable PDF, and when you are ready to buy or sell a property, give Babette at Aiosa Realty Group a call at 727-585-4804 or 727-439-9029.

There are mandatory house mortgage steps that must be completed before a mortgage loan is approved and handed over to the buyer from the loan originator. One very important task is the hiring of a Title Company to do a title search to ensure that the mortgage is legal, taxes are paid, there are no existing leans, and more! So, click

There are mandatory house mortgage steps that must be completed before a mortgage loan is approved and handed over to the buyer from the loan originator. One very important task is the hiring of a Title Company to do a title search to ensure that the mortgage is legal, taxes are paid, there are no existing leans, and more! So, click  Are You thinking of purchasing a home or selling your own home?

Are You thinking of purchasing a home or selling your own home? Yes, we here in Florida are still in a Seller’s Market. This means there are less homes for sale with more buyers ready to purchase. If you are planning to purchase a home and are afraid of missing out on your perfect dream home, it would behoove you to not only be prequalified for a loan but also be pre-approved for a mortgage, and then go in to win with your best offer or you may lose out as you may be contending with other offers on the table. So, to check out how you can stay front and center in a seller’s market, click

Yes, we here in Florida are still in a Seller’s Market. This means there are less homes for sale with more buyers ready to purchase. If you are planning to purchase a home and are afraid of missing out on your perfect dream home, it would behoove you to not only be prequalified for a loan but also be pre-approved for a mortgage, and then go in to win with your best offer or you may lose out as you may be contending with other offers on the table. So, to check out how you can stay front and center in a seller’s market, click  Have you ever asked yourself, “how am I ever going to be able to afford to buy a home when house prices keep going up?” I found myself asking that very same question and wondering how other people were capable of purchasing homes, especially when property value appreciation is about to go up again.

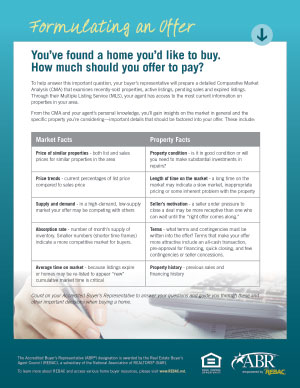

Have you ever asked yourself, “how am I ever going to be able to afford to buy a home when house prices keep going up?” I found myself asking that very same question and wondering how other people were capable of purchasing homes, especially when property value appreciation is about to go up again. There are many factors involved when formulating an offer on a property, i.e., How long has it been on the market?; Are the sellers motivated?; Does it need a lot of fixing up?, just to name a few. Your realtor will be able to help you determine an acceptable offer.

There are many factors involved when formulating an offer on a property, i.e., How long has it been on the market?; Are the sellers motivated?; Does it need a lot of fixing up?, just to name a few. Your realtor will be able to help you determine an acceptable offer.